Get the Facts: Research in Canada is in Trouble

Research in Canada is in trouble. After two decades of stagnating investment, our health research and innovation ecosystem is woefully underfunded. Previous federal investments, including Budget 2018’s historic investment of nearly $4 billion, have since plateaued and been erased by the effects of inflation. As a result, our ability to generate innovative health solutions, respond to future health emergencies, retain a robust science, technology, engineering and mathematics (STEM) workforce and remain globally competitive is being hindered, jeopardizing Canada’s status as an innovation nation.

THE FACTS

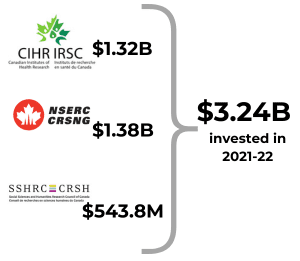

In 2021-22, the Government of Canada invested $3.24B in research.

Compared to our global peers, Canada has fallen way behind.

- In 2021, Canada invested just 1.7% of our GDP on R&D compared to the U.S. at 3.5%, Japan at 3.3%, Germany at 3.1%, the U.K. at 2.9% and Australia at 1.8%.

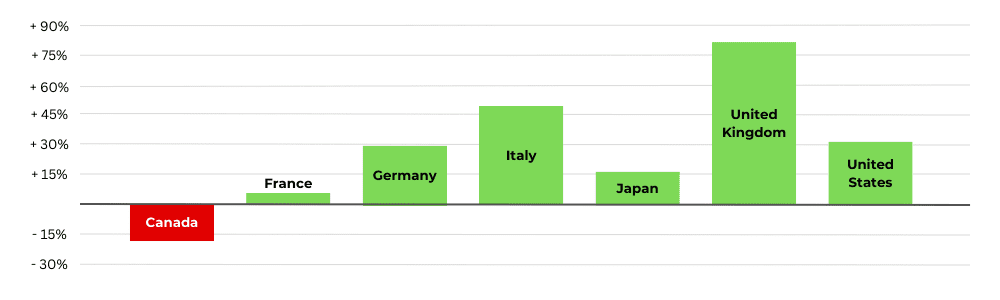

- We are the only nation in the G7 whose R&D spending as a percentage of GDP has fallen over the past two decades.

G7 nations’ change in R&D spending as a percentage of GDP, 2000-current

On health research specifically, Canada’s history of underfunding is even more apparent.

- Canada spends just 1.5% of its total public health spending on research compared to Australia at 3.3% and the U.S. at 5.9%.

- The U.S. spends $196.23 (Canadian dollars) per capita on health research funding via its National Institutes of Health (NIH). Canada’s per capita spending is $31.80 through the Canadian Institutes of Health Research (CIHR)—that’s just 16% of what the U.S. spends per capita. Even combining the budgets of all three of Canada’s granting councils amounts to just 40% of the NIH’s spending.

Canada’s underfunding of research means we are not able to adequately or competitively support our young and emerging research talent.

- Annual stipends provided to PhD students are generally under $30,000 annually, an amount that is insufficient for the average one-bedroom rental across Canada. This problem is only compounded for researchers from Indigenous, Black, and other underrepresented and marginalized communities who typically face additional social, economic and structural barriers and challenges.

- Federal grants for graduate students and trainees have also stagnated over the past two decades. The Canada Graduate Scholarships for master’s students (CGS-M) at $17,500 and the Postgraduate Scholarships for doctoral candidates (PSG-D) at $21,000, for example, have not increased since 2003.

- Up to 3,000 Canada Graduate Scholarships are awarded each year to master’s and doctoral students each. More prestigious awards like the Vanier Canada Graduate Scholarships Banting Postdoctoral Fellowships are even more exclusive, leaving the vast majority of Canada’s young research talent to rely on stipends from their institutions.

- Consequently, Canada is experiencing a brain drain, with a recent study suggesting that one in four STEM graduates opt to work outside of Canada due to better financial supports for research and researchers available in other countries.

- The majority of STEM graduates that leave Canada go to the U.S. where they can make, on average, between 20% and 30% more than they would in Canada.

- BioTalent Canada estimates that the biotechnology industry will be facing a shortfall of 65,000 workers by 2029. Other sectors, including the biomanufacturing sector, will face similar challenges due in part to the underfunding of research and the resultant loss of world-class talent.

INVESTMENT IN HEALTH RESEARCH IS CRITICAL TO CANADA’S FUTURE

Other countries that are known for their strong industrial policy and for being top-tier destinations for life sciences companies invest heavily in research.

- The U.S., Japan, South Korea, Germany and Switzerland—all countries with thriving life sciences industries—have consistently invested in R&D as a percentage of GDP well above the OECD average for the past two decades.

These countries all recognize the critical relationship between research investment and industrial policy.

These countries all recognize the critical relationship between research investment and industrial policy.

- The European Union’s industrial strategy “highlights the importance of research and innovation in providing the technological foundation to transform and strengthen industrial value chains, helping to turn sustainability and digital challenges into business opportunities.”

- Australia’s biotechnology sector has grown by more than 60% since 2017, and while the country saw a decrease in R&D spending after 2008 the Australian government has since reinvigorated its commitment to medical research funding, stating that “basic research discovery processes are at the core of a biotechnology ecosystem.”

- In the U.S., the CHIPS and Science Act of 2022 provided an historic investment in R&D, roughly doubling the budget of research agencies and directing $280 billion in spending over the next ten years, with the bulk for scientific R&D.

- To achieve its ambitions of being a science superpower and deliver on its innovation strategy, the U.K. government recently committed record levels of investment in its world-leading research base between 2022 and 2025, with R&D spending set to increase by £5 billion to £20 billion per annum by 2024-2025 – a 33% increase in spending over 2021-2022.

THE OPPORTUNITY

Budget 2024 must seize the opportunity to become a world-leading economic and innovation nation. Maximizing the impact of recent—and future—investments in biomanufacturing and realizing the objectives of industrial and economic policies and investments hinge on the existence of a robust and properly funded health research ecosystem. Reinvestment in health research is urgently needed to develop and retain diverse, world-class talent and a strong, highly skilled STEM workforce. It is vital to promoting health security and to attracting FDI that will lead to new health innovations and a globally competitive economy.

Reinvestment in health research is also critical to ensuring that health innovations and the future of health care reflect the needs and priorities of all Canadians. Novel discoveries and research programs that deliver impact to a wide range of communities depend on nurturing and developing the broadest and brightest talent pool within the health research ecosystem.

Budget 2024 needs to reinvest in both research and people by immediately doubling research funding to the Tri-Agency and committing to:

|

SOURCES

- Canadian Institutes of Health Research. CIHR in Numbers.

- Natural Sciences and Engineering Research Council of Canada. NSERC Interactive Dashboard.

- Natural Sciences and Engineering Research Council of Canada. 2021-22 Departmental Plan.

- Social Sciences and Humanities Research Council. SSHRC’s investments Interactive Dashboard.

- Organisation for Economic Co-operation and Development (OECD). Gross domestic spending on R&D.

- Investment Monitor. The US remains the world’s leading life sciences investment destination, March 9, 2022.

- European Commission. Research and innovation: Industrial policy.

- Australian Biotechnology Sector Snapshot, 2022.

- Australian Government, Department of Health. Biotechnology in Australia: Strategic plan for health and medicine, 2022.

- uk. Government announces plans for largest ever R&D budget, March 14, 2022.

- Congressional Research Service. National Institutes of Health Funding: FY1996-FY2023, updated March 8, 2023.

- United States Census Bureau. S. and World Population Clock.

- Canada’s population estimates, first quarter 2023.

- Canadian Centre for Policy Alternatives. Can’t afford the rent: Rental wages in Canada 2022, July 2023.

- Crawley, Mike (CBC). Canada’s grants for master’s, PhD students haven’t increased since 2003. These researchers want that changed, December 24, 2022.

- Spicer, Z., Olmstead, N. and Goodman, N. Reversing the Brain Drain: Where is Canadian STEM Talent Going?